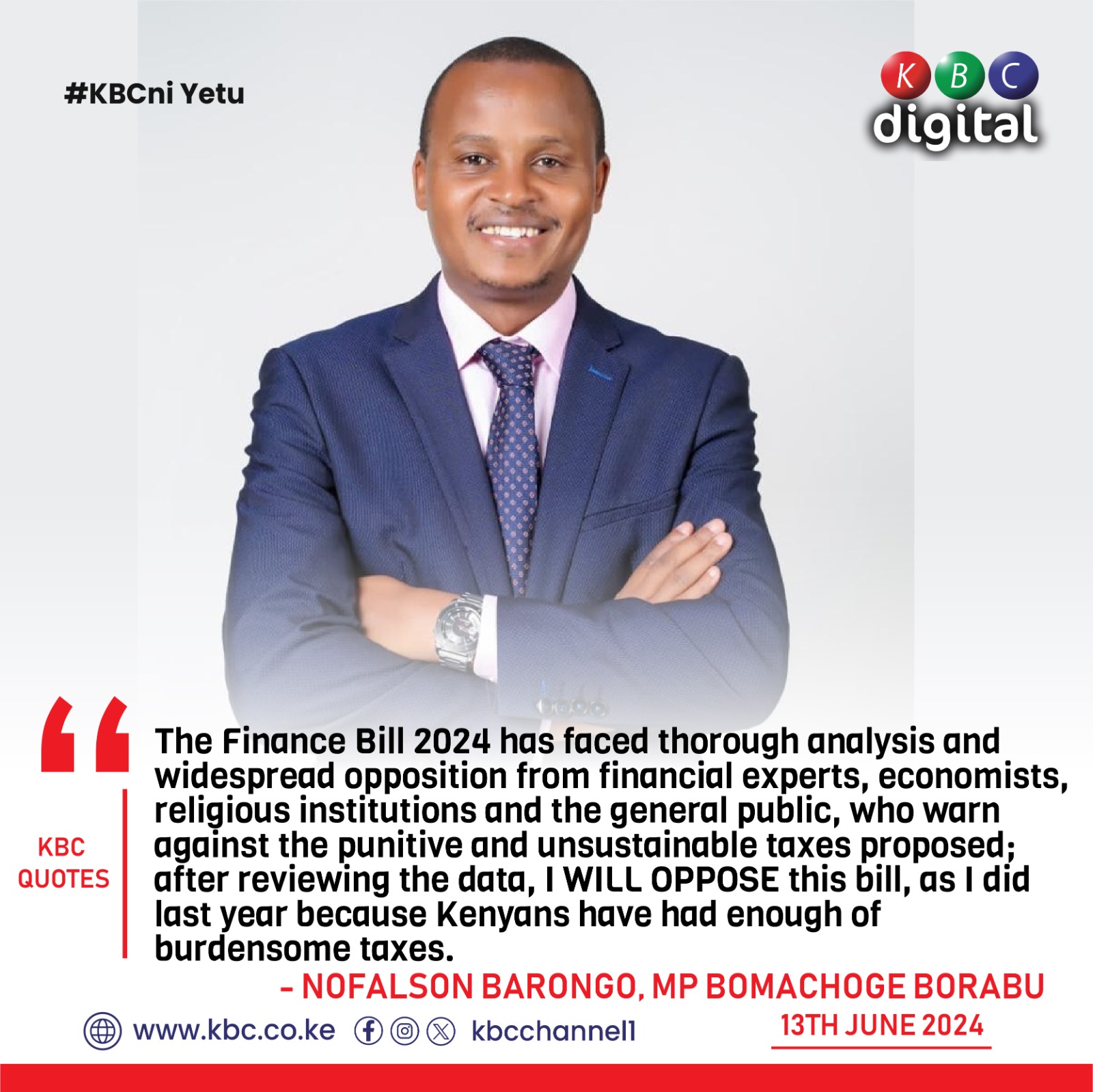

The Finance Bill 2024 has faced extensive analysis and widespread opposition from various segments of society, according to Nofalson Barongo, Member of Parliament for Bomachoge Borabu.

“Financial experts, economists, and the business community have all scrutinized the bill, resulting in a clear consensus against it during public participation sessions,” Barongo reported.

Barongo also noted on X that religious institutions have voiced their opposition to the bill, with representatives expressing concerns about its ethical implications and the potential burden on their congregations.

He observed that manufacturers and businesses of all sizes have spoken out, warning that the proposed taxes could stifle economic growth and harm the business environment.

“International financiers have raised alarms about the sustainability of the proposed taxes,” he added, highlighting their caution that such measures could undermine investor confidence and potentially lead to economic instability.

The general public has issued strong warnings to the government against implementing what they described as punitive taxes.

According to Barongo, citizens argued that the increased tax burden would exacerbate the cost of living and negatively impact their daily lives.

Economists and analysts have expressed scepticism regarding the projected benefits of the new taxes.

Barongo relayed their concerns, stating that they have questioned the government’s optimistic revenue forecasts and warned that the excessive taxes could hinder economic progress.

Reflecting on the widespread frustration, Barongo emphasized calls for the government to reconsider the proposed financial measures.

As the Finance Bill 2024 moves forward, Barongo underscored the significant challenges it faces, with opposition continuing to build from multiple fronts.

Barongo’s sentiments come amid the National Treasury and Economic Planning’s announcement that a total expenditure amounting to Ksh 3.99 trillion for the 2024/25 financial year beginning July 1, 2024, is required.

While presenting the budget statement before the National Assembly on Thursday, Treasury Cabinet Secretary Prof. Njuguna Ndung’u said the government plans to raise a total of Ksh 3.34 trillion, equivalent to 18.5% of the country’s gross domestic product (GDP), through revenue collection and appropriations-in-aid.

Of this amount, the Kenya Revenue Authority (KRA) is expected to collect a total of Ksh 2.92 trillion in ordinary revenue.

Ministerial appropriations-in-aid will amount to Ksh 426 billion, while the government expects a total of Ksh 51.8 billion, or 0.3% of GDP, in grants from development partners.

Out of the total budget, Prof. Ndung’u said recurrent expenditure will amount to Ksh 2.84 trillion, while development expenditure, including allocations to domestic and foreign-financed projects, the contingency fund, and the equalization fund, will amount to Ksh 707.4 billion, equivalent to 3.9% of GDP.

Counties are also expected to receive a total of Ksh 444.5 billion, out of which equitable share will amount to Ksh 400.1 billion.