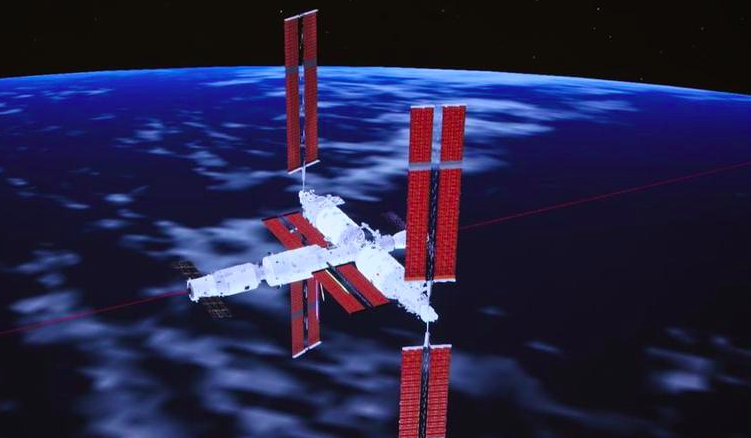

China has taken a significant step in space logistics and commercial space advancement with the introduction of low-cost cargo spacecraft, including a space cargo shuttle, tailored to meet the frequent supply needs of its space station.

The China Manned Space Agency (CMSA) revealed on Oct. 29 the winners of its solicitation for overall schemes aimed at the low-cost cargo transportation system, a crucial component of the space station’s operations.

After two rounds of selection, schemes respectively from the Innovation Academy for Microsatellites of the Chinese Academy of Sciences (IAMCAS) and from the Chengdu Aircraft Design and Research Institute under the Aviation Industry Corporation of China (AVIC) finally won the contracts for the flight verification phase, said Lin Xiqiang, deputy director of the CMSA.

The IAMCAS-developed Qingzhou cargo spacecraft features an integrated single-capsule configuration with a cargo volume of up to 27 cubic meters. This expansive capacity is set to significantly cut cargo transportation costs and enhance flexibility in logistics.

Equipped with an intelligent transportation system, the Qingzhou is capable of accommodating a variety of space science payloads, supporting both manned and unmanned in-orbit experiments.

The cargo spacecraft is scheduled to be launched by the Lijian-2 rocket, which is manufactured by CAS Space.

The Haolong space cargo shuttle, developed by the Chengdu Aircraft Design and Research Institute under the AVIC, is a winged, reusable spacecraft. It incorporates a large wingspan, high lift-to-drag ratio, and a reusable technology plan.

Leveraging cutting-edge aviation technologies, the Haolong is capable of being launched by a carrier rocket, docking with the space station, and upon separation, executing de-orbit braking and re-entry maneuvers, culminating in a horizontal landing on an airport runway. It also possesses excellent flight performance in both atmospheric and space environments.

The selection process has engaged scientific research institutes and commercial space companies in developing spacecraft, rockets and other flight products for China’s manned space program, Lin said.

Lin noted that this strategic move will not only slash cargo transportation costs for the space station but also pave the way for new opportunities in the growth of the country’s commercial space industry.

China has established a vibrant and competitive landscape in the low-cost cargo spacecraft sector. The involvement of established aerospace companies and emerging players is expected to fuel innovation and bolster the development of a healthy and orderly space logistics system.

Beyond CAS Space, several commercial space companies are actively advancing the development of reusable medium-lift launch vehicles, signaling a shift towards more sustainable and cost-effective space travel solutions.

The Zhuque-3 reusable rocket is currently undergoing the development of its system products in the preliminary design phase, and is scheduled for its maiden flight in 2025, with plans to achieve first-stage recovery and reuse by 2026, according to its developer LandSpace.

The company aims to make a breakthrough in large-capacity, low-cost, and reusable launch vehicle technology within the next three years, supporting the advancement of China’s commercial space industry, LandSpace said.

The emergence of these companies has invigorated the country’s commercial space market, propelling technological progress and industrial upgrading within the aerospace field.

Since 2015, the scale of China’s commercial space market has maintained rapid growth. According to data analysis provider iiMedia Research, the country’s commercial space market has seen a remarkable annual growth rate of over 20 percent since 2017, with the market size projected to soar to approximately 2.34 trillion yuan by 2024. ■